Installation

Sandbox via API

For API Testing, we recommend using POSTMAN

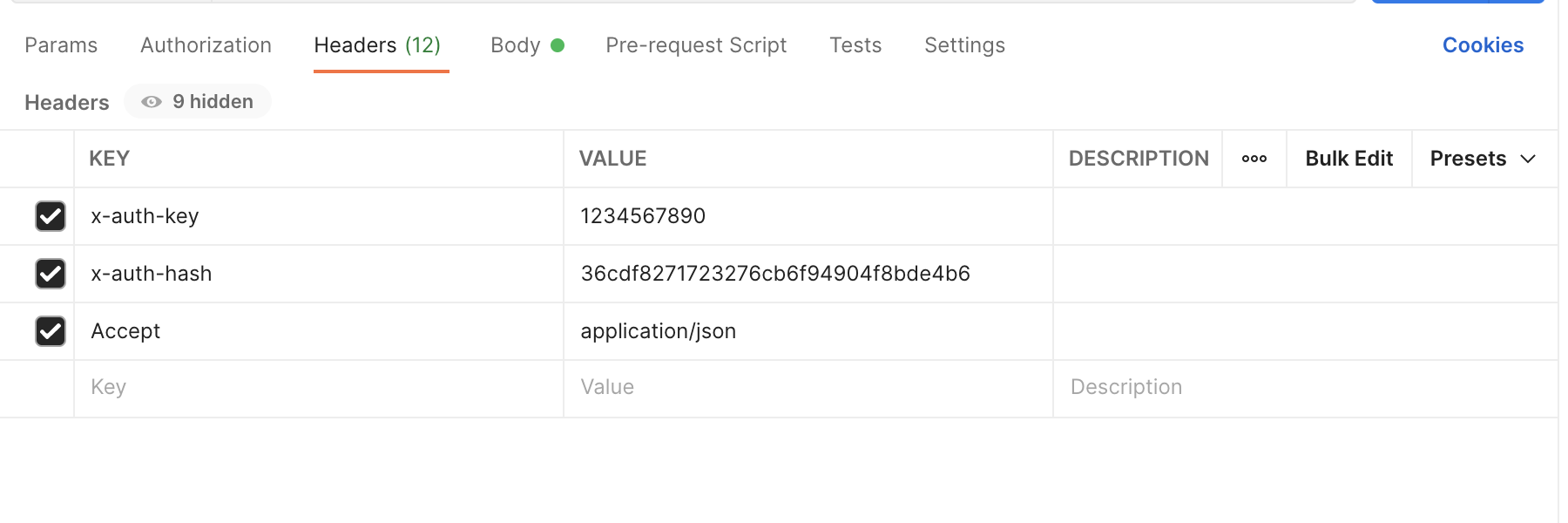

Header Structure

In order to use the API Sandbox, you must set up your headers first.

| Header | Value |

|---|---|

| x-auth-key: | 1234567890 |

| x-auth-hash: | 36cdf8271723276cb6f94904f8bde4b6 |

| Accept: | application/json |

Transaction Requests URLs

To test the API Transaction Sandbox, you must use the following URLs:

| URL | Transaction Type | Method |

|---|---|---|

https://pixelpay.dev/api/v2/transaction/sale |

SALE |

POST |

https://pixelpay.dev/api/v2/transaction/auth |

AUTH |

POST |

https://pixelpay.dev/api/v2/transaction/capture |

CAPTURE |

POST |

https://pixelpay.dev/api/v2/transaction/void |

VOID |

POST |

Tokenization Requests URLS

To test the API Tokenization Sandbox, you must use the following URLs:

| URL | Type | Method |

|---|---|---|

https://pixelpay.dev/api/v2/tokenization/card |

Tokenize Card | POST |

https://pixelpay.dev/api/v2/tokenization/card/{token} |

Edit Card | PUT |

https://pixelpay.dev/api/v2/tokenization/card/{token} |

Retrieve Card Information | GET |

https://pixelpay.dev/api/v2/tokenization/card/{token} |

Delete Card | DELETE |

Card tokens created in the Sandbox are automatically deleted 5 hours after being created.

Sandbox via SDK

To make integrations easier, PixelPay offers their Software Development Kit (SDK).

PixelPay's SDK provides an easy way to communicate data between the merchant's integration and PixelPay servers, avoiding the redirection to the provider's website to complete the payment process.

Implementation

The SDK can be implemented via NPM or by CDN. You can find the official packages below:

NPM: https://www.npmjs.com/package/@pixelpay/sdk-core

CDN: https://cdn.jsdelivr.net/npm/@pixelpay/sdk-core

// ES5 Import

import * as PixelPay from '@pixelpay/sdk-core';

// - o -

// CDN

<script src="https://cdn.jsdelivr.net/npm/@pixelpay/sdk-core"></script>

...

// Se instancia el setup del Sandbox

var settings = new Models.Settings();

settings.setupSandbox();As seen in the example above, the setupSandbox() method must be instantiated to change the SDK environment to Sandbox

General Information

Allowed Cards

To run tests in Sanbox, you should only use the following credt/debit cards:

| Number | Brand | CVV | Exp Date |

|---|---|---|---|

4111111111111111 |

VISA | 300 |

2512 |

5555555555554444 |

MASTERCARD | 999 |

2512 |

Test Cases

The sandbox environment allows simulating different types of transactions. To choose the type of response to receive, it is necessary to modify the value of the order_amount field within the request. Each amount will generate a different case, as shown below:

order_amount Value |

Response |

|---|---|

1 |

Successful Transaction |

2 |

Declined transaction |

3 |

Invalid Merchant Settings |

4 |

Card with Loss or Theft Report |

5 |

Error finding payment |

6 |

The attempt limit has been exceeded |

7 |

General System Error |

8 |

Time Out Error |

9 |

Transaction Amount Exceeded |

10 |

Transaction Limit Exceeded |

11 |

Transaction Amount Limit Exceeded |

12 |

Bin Number Limit |

13 |

Limit by type of Card |

14 |

Location Limit |

Test Cases for 3-D Secure 2.x

The following test cases can be used to test 3-D Secure authentication for each supported credit card brand.

These transactions only work with the Sandbox Case #1 and it's only required to replace the card.

Caso |

Visa | Mastercard |

|---|---|---|

(2.1) Successful Authentication |

4000000000001000 | 5200000000001005 |

(2.2) Failed Authentication |

4000000000001018 | 5200000000001013 |

(2.3) Attempts Stand-In Authentication |

4000000000001026 | 5200000000001021 |

(2.4) Unavailable Authentication from the Issuer |

4000000000001034 | 5200000000001039 |

(2.5) Rejected Authentication by the Issuer |

4000000000001042 | 5200000000001047 |

(2.6) Authentication Not Available on Lookup |

4000000000001059 | 5200000000001054 |

(2.7) Error on Lookup |

4000000000001067 | 5200000000001062 |

(2.8) Timeout on cmpi_lookup Transaction |

4000000000001075 | 5200000000001070 |

(2.9) Successful Step Up Authentication |

4000000000001091 | 5200000000001096 |

(2.10) Failed Step Up Authentication |

4000000000001109 | 5200000000001104 |

(2.11) Step Up Authentication is Unavailable |

4000000000001117 | 5200000000001112 |

(2.12) Error on Authentication |

4000000000001125 | 5200000000001120 |